Ares Management’s strategic investment in renewable energy, particularly through Eni’s Plenitude, significantly boosts Indian firms by providing necessary funding and resources, fostering sustainable practices essential for economic and environmental advancement.

Have you heard about how alternative credit is reshaping the renewable energy market? Ares Management’s recent acquisition of a stake in Eni’s Plenitude signals a transformative phase for Indian firms. Let’s dive into what this means for the future!

Investment strategies by Ares Management in renewable energy

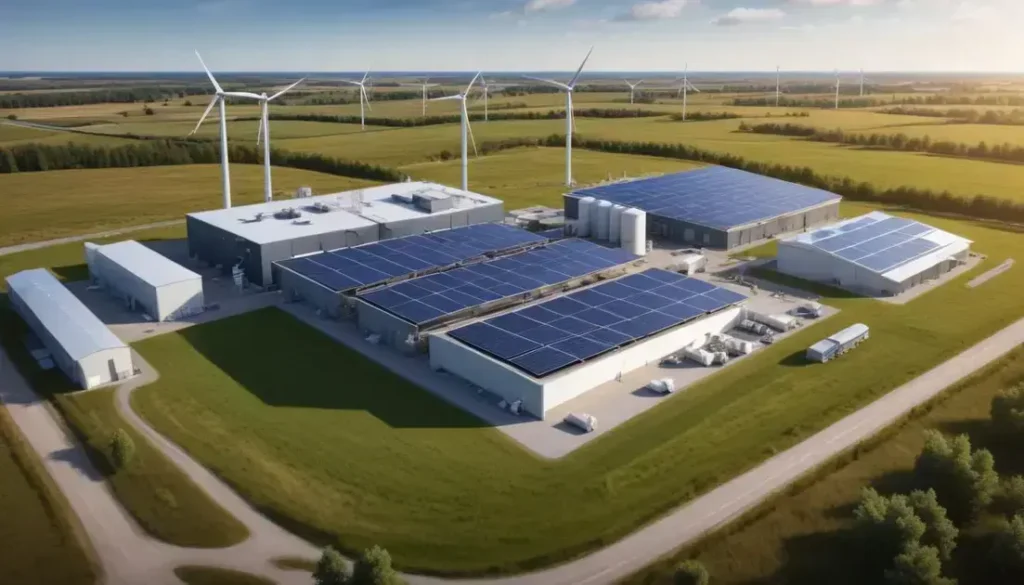

Ares Management is strategically positioning itself as a key player in the renewable energy sector, especially through investments in innovative companies like Eni’s Plenitude. This move not only enhances their portfolio but also contributes significantly to the growth of sustainable energy sources in India.

By focusing on alternative credit solutions, Ares aims to support projects that may otherwise struggle to secure funding. Their approach involves leveraging capital to bolster infrastructure that harnesses wind and solar energy, ensuring more sustainable practices are adopted across the board.

Investment Impact: The collaboration with Eni presents unique opportunities for Indian businesses to access the necessary resources to thrive in the ever-evolving energy landscape. Ares Management’s investment offers a pathway for Indian firms to tap into advanced technologies and methodologies, enabling them to enhance operational efficiency.

Furthermore, the focus on renewable energy aligns with global initiatives aimed at reducing carbon footprints. Ares’s strategy is not just about financial gain; it’s about paving the way for a greener future. As the demand for energy continues to rise, investments in these sectors will be crucial for sustainable development.

Embracing Renewable Energy Investments

Ares Management’s investments in the renewable energy sector are paving the way for a sustainable future in India. By supporting innovative projects, they are helping Indian firms access vital resources and technology to thrive.

These investments are not just about financial returns; they play a crucial role in enhancing environmental sustainability. As the demand for cleaner energy sources increases, collaboration between companies like Ares and Eni can lead to significant advancements.

As we move forward, it is essential for businesses to adapt and embrace renewable energy solutions. The positive impact on both the economy and the environment can be transformative, helping companies to grow while contributing to a greener planet.

Now is the time to harness these opportunities and invest in a sustainable future.

Frequently Asked Questions

What is the significance of Ares Management’s investment in renewable energy?

Ares Management’s investment is crucial as it provides necessary funding for renewable energy projects, enabling Indian firms to adopt sustainable practices and technologies.

How does alternative credit benefit renewable energy firms in India?

Alternative credit helps renewable energy firms secure the funding they need for projects that may not qualify for traditional financing, promoting growth in the sector.

Why is renewable energy important for Indian businesses?

Renewable energy is vital for Indian businesses as it reduces reliance on fossil fuels, lowers operational costs, and aligns with global sustainability goals.

What opportunities do investments in renewable energy present for Indian exporters?

Investments in renewable energy can open new markets for Indian exporters by enhancing their green credentials and meeting international demands for sustainable products.

How can companies prepare for a transition to renewable energy?

Companies can start by assessing their current energy usage, exploring renewable options, and engaging in pilot projects to transition smoothly towards sustainable energy sources.

What role does technology play in enhancing renewable energy investments?

Technology plays a critical role by improving efficiency in energy production, facilitating better resource management, and enabling data-driven decision-making for investments.