Long-Duration Energy Storage (LDES) enhances renewable energy management by storing energy for extended periods, ensuring consistent power supply while reducing reliance on fossil fuels.

Long-Duration Energy Storage is revolutionising how we think about energy sustainability. This innovative technology promises to reshape energy grids and enhance their reliability. Curious about its implications?

Overview of the LDES technology and its significance

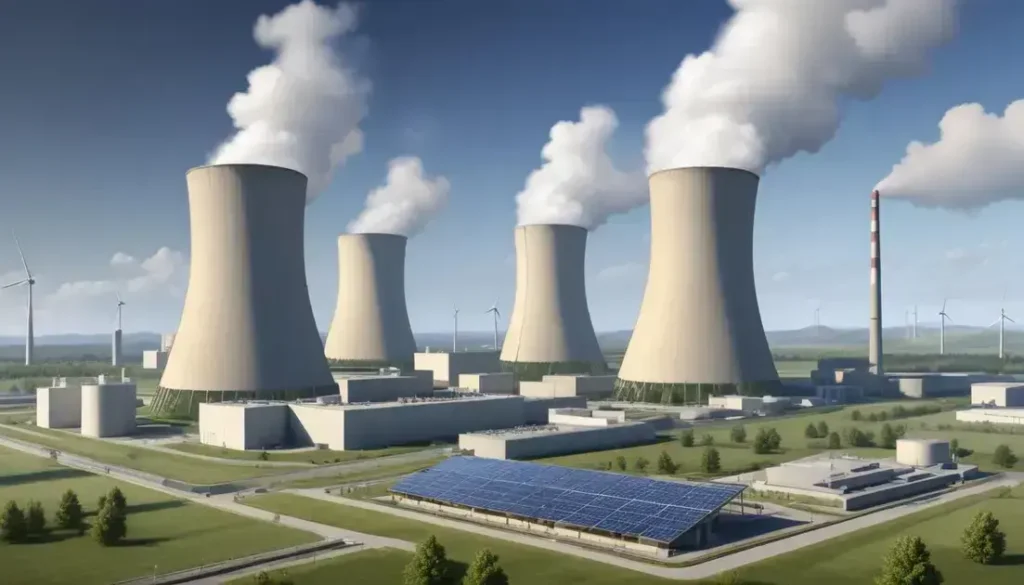

Long-Duration Energy Storage (LDES) represents a pivotal advancement in energy technology, addressing the critical need for efficient energy management. This technology is designed to store energy from renewable sources like solar and wind for extended periods, ensuring a steady supply even when generation is low.

LDES systems utilise methods such as pumped hydro, compressed air, and thermal storage, each offering unique advantages. For instance, thermal storage employs molten salts to capture excess heat energy, while pumped hydro relies on the gravitational potential of water. These methods not only provide longevity in energy storage but also enhance the stability of power grids.

The significance of LDES is underscored by its potential to mitigate the intermittency of renewable energy sources, thus facilitating the transition to a more sustainable energy future. It enables utilities to balance supply and demand, reducing reliance on fossil fuels. As countries strive to meet net-zero targets, LDES is becoming a key player in driving decarbonisation efforts.

Furthermore, investments in LDES technologies are increasing, with financial institutions recognising their value in shaping a resilient energy landscape. By integrating LDES into the existing grid infrastructure, countries can enhance energy security and promote economic growth through job creation in green technologies.

BBVA’s role in funding green energy projects

BBVA is emerging as a key player in the financing of green energy projects, showcasing a commitment to sustainable investment. The bank supports initiatives aimed at harnessing renewable resources, including solar, wind, and Long-Duration Energy Storage (LDES) systems. By providing capital to these projects, BBVA not only enhances its portfolio but also contributes significantly to the transition towards a low-carbon economy.

Through its Green Bond Framework, BBVA has facilitated funding that directly aligns with environmental objectives. This approach allows for the mobilisation of investments in projects that have a measurable impact on reducing greenhouse gas emissions. Furthermore, the bank actively collaborates with stakeholders, ensuring that funded projects meet stringent sustainability criteria.

BBVA’s strategic involvement in green energy financing is also focused on innovative technologies that promise efficiency and scalability. By investing in emerging technologies, the bank is helping to shape a future where sustainable energy sources dominate the market. This aligns with global efforts to combat climate change and promotes energy independence.

As green finance continues to evolve, BBVA’s role will likely expand, paving the way for increased investment in sustainable infrastructure. The bank’s leadership in this domain reinforces the importance of financial institutions in supporting the global energy transition.

In conclusion, the future of green energy financing

The role of financial institutions like BBVA in supporting green energy projects is crucial for a sustainable future. Their investment in technologies such as Long-Duration Energy Storage helps shape a low-carbon economy, making renewable energy more accessible.

As the demand for cleaner energy grows, collaboration between banks, businesses, and governments will be vital. By working together, we can address the challenges of climate change while promoting economic growth.

In summary, BBVA’s commitment to funding sustainable initiatives sets a strong example for others in the financial sector. Embracing green finance is not just good for the planet; it’s also a smart business decision.

Frequently Asked Questions

What is Long-Duration Energy Storage (LDES)?

Long-Duration Energy Storage (LDES) refers to technologies that store energy from renewable sources for extended periods, enabling a consistent power supply when generation is low.

How does BBVA contribute to green energy financing?

BBVA supports green energy projects through investments and its Green Bond Framework, which funds initiatives aimed at reducing greenhouse gas emissions.

Why is LDES important for renewable energy?

LDES is crucial as it helps address the intermittency of renewable energy sources, allowing for a more stable and reliable energy grid.

What types of technologies are included in LDES?

LDES technologies include pumped hydro, compressed air, and thermal storage systems, each offering unique capabilities for energy management.

How can businesses benefit from green financing?

Businesses can benefit from green financing by accessing funds for sustainable projects, enhancing their reputation, and contributing to environmental goals.

What role do financial institutions play in sustainability?

Financial institutions play a critical role by providing the necessary capital for sustainable initiatives, fostering innovation, and supporting the transition to a low-carbon economy.